For decades, U.S. investors have exhibited a pronounced home-country bias. That bias shows up in portfolios that overweight U.S. equities relative to their share of global market capitalization. In 2026, however, there are growing signs that this dynamic is beginning to shift.

The change has been broadly labeled the “Sell America” trade, reflecting a reassessment of how much capital investors want concentrated in U.S. stocks. Several factors are driving that narrative.

Over the last year, the U.S. dollar index has weakened materially, eroding the currency advantage that once supported U.S. asset returns. Moreover, equity valuations in the U.S. remain elevated and increasingly concentrated among a small group of mega-cap technology companies.

At the same time, persistent fiscal standoffs over the debt ceiling, rising government borrowing costs and bouts of domestic political unrest have added uncertainty. Layered on top of that is a more erratic foreign policy backdrop, marked by on-again, off-again tariff threats.

That combination has pushed capital toward international equity funds, including both mutual funds and exchange-traded funds (ETFs), that invest outside the U.S.

“Our 2026 outlook indicates that over the next decade, international equity markets offer strong risk-adjusted prospects, supported by low valuations and high dividend yields,” says Katherine Kellert, head of index equity product at Vanguard.

On the developed market side, this includes countries such as Canada, the U.K., France, Germany and Switzerland. Emerging markets span economies like Brazil, India, Mexico and Saudi Arabia.

According to data from ETF Central, emerging-market blended-cap ETFs in particular ranked among the top categories for trailing three-month net inflows, attracting $26.7 billion while delivering an average return of roughly 7% across 31 funds.

By comparison, U.S. large-cap ETFs only returned about 1% over the same period, even as they continued to dominate absolute inflows with $123.7 billion.

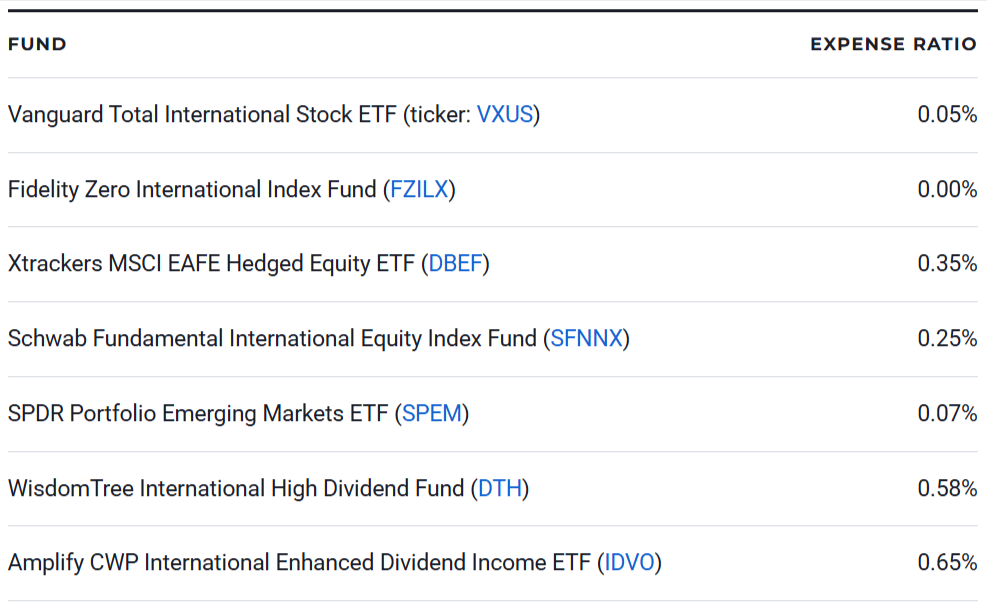

Here are seven of the best international stock funds to buy for 2026:

Fund

Vanguard Total International Stock ETF (ticker: VXUS)

Fidelity Zero International Index Fund (FZILX)

Xtrackers MSCI EAFE Hedged Equity ETF (DBEF)

Schwab Fundamental International Equity Index Fund (SFNNX)

SPDR Portfolio Emerging Markets ETF (SPEM)

WisdomTree International High Dividend Fund (DTH)

Amplify CWP International Enhanced Dividend Income ETF (IDVO)

Vanguard Total International Stock ETF (VXUS)

“VXUS is an effective, low-cost way to gain exposure to non-U.S. stocks,” Kellert says. “The fund holds thousands of companies across developed and emerging markets and delivered strong performance over the past year, reflecting broad international strength.” This ETF tracks the FTSE Global All Cap ex US Index for an affordable 0.05% expense ratio, and is also available as a mutual fund share class.

For passive index-tracking ETFs like VXUS, Vanguard has spent decades refining portfolio management to minimize tracking error. This refers to the difference between a fund’s net asset value (NAV) return and that of its index benchmark. Vanguard minimizes tracking error through careful rebalancing to align with index changes, low-turnover trading and efficient cash management to reduce drag.

Fidelity Zero International Index Fund (FZILX)

“Adding international stocks to your portfolio can dampen volatility and improve returns, since the U.S. economy and market may face challenges at different times compared to international regions,” says Scott Klimo, chief investment officer at Saturna Capital. “Mitigating currency risk also plays a role, as the U.S. dollar may strengthen or weaken versus other countries at different times.”

FZILX goes a step further on cost than VXUS by charging a true 0% expense ratio. Fidelity achieves this by using a proprietary benchmark, the Fidelity Global ex U.S. Index, which eliminates third-party index licensing fees. The fund also relies on sampling rather than full replication to reduce transaction costs, while income from securities lending helps offset the remaining operating expenses.

Xtrackers MSCI EAFE Hedged Equity ETF (DBEF)

“The ex-U.S. market makes up about 40% to 45% of the world’s market capitalization, so by ignoring international stocks, investors are missing out on roughly half the world’s investing opportunities,” says Kirk Kinder, director of financial planning at Bastion Fiduciary. “Moreover, international stocks are substantially undervalued when you look at metrics like price-to-earnings and price-to-book ratios.”

Some investors hesitate due to the long-term underperformance of international stocks, but much of that gap reflects a strong U.S. dollar over the past decade. A currency-hedged option like DBEF is designed to remove that foreign exchange volatility. Over the past 10 years, DBEF delivered a 10.5% annualized return after a 0.35% expense ratio, compared with 8.2% for the unhedged MSCI EAFE Index.

Schwab Fundamental International Equity Index Fund (SFNNX)

Most international equity funds, particularly index-based ones, weight holdings by market capitalization. The larger the company, the larger its weight, which can work well in bull markets as indexes tend to be self-cleansing, with winners naturally rising to the top. The downside is that this approach can introduce concentration risk if investors enter the market at the wrong point in the cycle.

SFNNX takes a different approach by using fundamental weighting. The fund tracks the RAFI Fundamental High Liquidity Developed ex US Large Index, which emphasizes lower price-to-earnings ratios and higher dividend yields. Over the past 10 years, SFNNX has earned a five-star rating from Morningstar, outperforming most of the 243 funds in its peer category on a risk-adjusted basis.

SPDR Portfolio Emerging Markets ETF (SPEM)

Prior to the rise of low-cost ETFs, emerging market exposure was typically expensive and harder for retail investors to access. The rapid expansion of the ETF universe has driven fee compression, meaning costs have steadily fallen even in traditionally niche, less liquid or higher-risk segments. Emerging markets are a clear beneficiary of this trend. SPEM is a good example, charging a 0.07% expense ratio.

The fund tracks the S&P Emerging BMI Index, with BMI standing for broad market index, covering large-, mid- and small-cap stocks. While the index includes more than 7,200 securities, SPEM holds over 3,000 stocks and uses a sampling approach to keep costs low while minimizing tracking error. Over the last 10 years, SPEM has returned an annualized 8.6% with distributions reinvested.

WisdomTree International High Dividend Fund (DTH)

International equities already tend to offer higher yields than U.S. stocks on average, but a dividend-focused strategy can push income even higher. DTH does this by tracking the WisdomTree International Equity Index, which uses a fundamentally weighted approach. The index selects the top 30% of stocks ranked by dividend yield and then weights them by the total cash dividends paid.

The resulting portfolio has a clear tilt toward financial and industrial companies, sectors that traditionally support higher payouts. On a country basis, the largest exposures come from the U.K., Japan and France. The bias toward dividend-paying companies also introduces a value-stock tilt. After accounting for a 0.58% expense ratio, DTH currently offers a 3.8% 30-day SEC yield.

Amplify CWP International Enhanced Dividend Income ETF (IDVO)

To further increase income potential from international stocks, an options-based ETF like IDVO can be useful. The core of the fund is a concentrated portfolio of 30 to 50 companies selected from the MSCI ACWI ex USA Index, based on factors such as earnings growth, free-cash-flow growth and dividend growth. IDVO also actively manages sector and country exposure in terms of portfolio weights.

Layered on top of that equity exposure is a covered call strategy implemented at the individual stock level, which caps upside in exchange for enhanced income. IDVO estimates that roughly 3% to 4% of its yield comes from dividends, with an additional 2% to 4% generated from option premiums. After accounting for a 0.65% expense ratio, the ETF offers a 6.2% distribution yield with monthly payouts.