Great dividend stocks aren’t just defined by a big yield. The best dividend stocks to buy now feature consistency in operations and significant scale to weather short-term disruptions.

Sure, a big payday is nice while it lasts. But some of the stocks with the highest dividend yields are living on borrowed time and may soon see those payouts dry up. Instead, investors should prioritize steady cash flow, reliable businesses and positive share momentum.

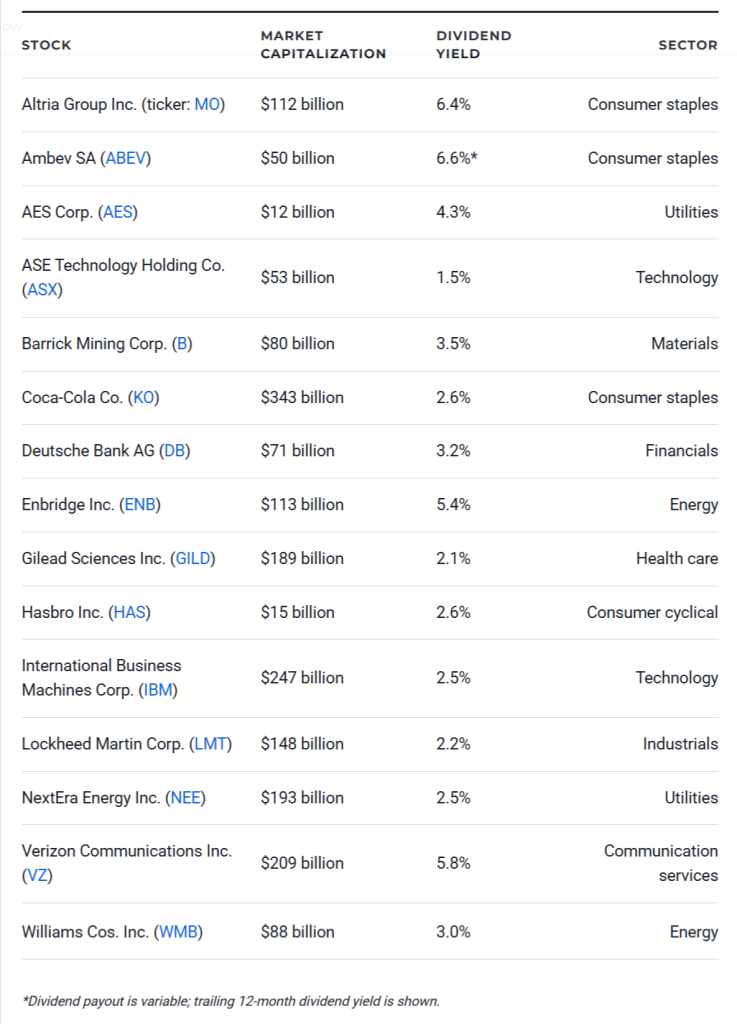

The following 15 companies fit that mold, and are among the best dividend stocks to buy now. All feature impressive dividend yields, a market value of more than $10 billion and double-digit gains in share price over the last 12 months.

Here are the top dividend stocks to buy now:

Stock

Altria Group Inc. (ticker: MO)

Ambev SA (ABEV)

AES Corp. (AES)

ASE Technology Holding Co. (ASX)

Barrick Mining Corp. (B)

Coca-Cola Co. (KO)

Deutsche Bank AG (DB)

Enbridge Inc. (ENB)

Gilead Sciences Inc. (GILD)

Hasbro Inc. (HAS)

International Business Machines Corp. (IBM)

Lockheed Martin Corp. (LMT)

NextEra Energy Inc. (NEE)

Verizon Communications Inc. (VZ)

Williams Cos. Inc. (WMB)

Altria Group Inc. (MO)

Sector: Consumer staples

Market value: $112 billion

Dividend: 6.4%

A favorite among dividend investors, tobacco giant Altria offers one of the highest yields available among large-cap U.S. stocks as well as unrivaled operational stability thanks to an addictive product that sees strong sales in any economic environment. Best known for brands such as Marlboro cigarettes and Skoal smokeless tobacco, the company generates predictable cash flow that has allowed MO to raise its dividend for more than 56 consecutive years. Shares have climbed roughly 25% over the past year or so, showing that share price appreciation can also come alongside a generous payout from this dividend stock.

Ambev SA (ABEV)

Sector: Consumer staples

Market value: $50 billion

Dividend: 6.6%

Ambev is one of the best dividend stocks to buy now because it provides exposure to consumer growth across Latin America through a diversified beverage portfolio including beer, soft drinks, sports drinks and energy beverages. Brands it distributes include beers like Budweiser, Modelo, Stella Artois and Michelob, while its non-alcoholic offerings span Pepsi, Gatorade, Lipton and Red Bull products. Founded in 1885, Ambev acts as a regional operating powerhouse for many global brands while remaining closely aligned with local tastes and economic conditions. Shares have surged about 75% in the last 12 months, and a big dividend increase in December brings the annualized yield to about six times that of the S&P 500 at present.

AES Corp. (AES)

Sector: Utilities

Market value: $12 billion

Dividend: 4.3%

AES operates diversified power generation resources across the U.S., including coal, gas, hydro, wind, solar and biomass facilities. Its total power portfolio can crank out almost 35,000 megawatts and distributes power to 2.6 million customers. Like most utilities, AES has a very entrenched user base and a wide moat against competition. Its 70-cent dividend is only about a third of expected earnings, providing confidence in the sustainability of payouts as well as the potential for future dividend increases.

ASE Technology Holding Co. (ASX)

Sector: Technology

Market value: $53 billion

Dividend: 1.5%

Taiwan-based tech leader ASE focuses on packaging, testing and manufacturing semiconductors. This is a critical service for a global semiconductor industry that is seeing incredible global growth right now. In fact, many high-profile chip designers don’t have production facilities and instead rely on ASE to turn their patented product schemes into real-world semiconductors. Margins may be thinner at ASE, but the business is reliable. The firm is plotting double-digit growth in 2026 – and more importantly, has seen shares more than double over the last 12 months thanks to a strong outlook fueling strong sentiment on Wall Street.

Barrick Mining Corp. (B)

Sector: Materials

Market value: $80 billion

Dividend: 3.5%

Barrick Gold is one of the world’s largest mining companies, with significant gold, silver and copper reserves spread across multiple continents. Gold’s role as an inflation hedge and alternative asset has been a big story over the last year or so, with the precious metal surging to an all-time high in early 2026. Naturally, that has driven strong performance for Barrick shares and fueled generous dividend payments to shareholders. The stock has surged about 140% over the last 12 months and is up year to date to boot, as the U.S. dollar has flagged to start the year and metals prices have remained strong.

Coca-Cola Co. (KO)

Sector: Consumer staples

Market value: $343 billion

Dividend: 2.6%

Coca-Cola is one of the most recognizable brands in the world, and is one of the best dividend stocks to buy now thanks to stable operations in any economic environment. Its product portfolio includes Coca-Cola, Gatorade and Minute Maid beverages, allowing KO to dominate across categories and geographies. The company has operated for more than 130 years and has increased its dividend for over six decades, a track record that’s unmatched on Wall Street. While its growth is admittedly more subdued than flashy tech stocks, Coca-Cola’s ability to generate reliable cash flow and return it to shareholders makes it a gold standard for dividend investors.

Deutsche Bank AG (DB)

Sector: Financials

Market value: $71 billion

Dividend: 3.2%

While not as close to home as big U.S. financial firms, Germany’s Deutsche Bank is a global powerhouse in asset management, and is increasingly one of the go-to partners for businesses and governments across the European Union in an age of trade disputes. The strategic value of a homegrown megabank like DB aside, the bank has an objectively attractive pedigree. It was founded in 1870 and ranks as one of the 30 largest financial institutions in the world as measured by assets. Shares are up around 80% in the last 12 months and have more than tripled since their 2023 lows in addition to a generous and sustainable dividend.

Enbridge Inc. (ENB)

Sector: Energy

Market value: $113 billion

Dividend: 5.4%

Enbridge is one of North America’s largest energy infrastructure companies, operating a “midstream” business of pipelines and storage facilities that are in between upstream production and downstream sales and distribution. This provides a measure of certainty for this dividend stock, as it is more of a a toll collector transporting oil and gas rather than cashing in based on fluctuating commodity market prices or short-term demand trends. ENB stock supports stable cash flow and an attractive dividend as a result.

Gilead Sciences Inc. (GILD)

Sector: Health care

Market value: $189 billion

Dividend: 2.1%

Gilead is one of the hottest stocks in the health care sector thanks to its leadership in HIV/AIDS treatments and specialized cancer therapies. The stock is up more than 45% in the last 12 months thanks to strong margins and consistent revenue growth. What’s more, dividends of 82 cents per share have surged from just 43 cents in early 2016 as the company has continued to share the wealth via quarterly distributions. The health care sector in general is a recession-proof bet, as demand for treatments stays strong regardless of broader spending trends, making GILD a low-risk stock with a high dividend.

Hasbro Inc. (HAS)

Sector: Consumer cyclical

Market value: $15 billion

Dividend: 2.6%

Cyclical consumer stocks are hard to rely on for consistent payouts, but toy giant Hasbro has a massive brand and quality product portfolio that gives it a measure of consistency. The firm is probably best known for old school games like Monopoly and childhood staples like Nerf guns and Play-Doh. However, it has been on a tear lately thanks to its arm that owns the Magic: The Gathering and Dungeons & Dragons brands, which continue to connect with new customers. With a strong foundation thanks to the power of nostalgia along with generous dividends that remain only about half of total earnings, HAS stock is among one of the best dividend stocks to buy now after gains of around 75% over the last 12 months.

International Business Machines Corp. (IBM)

Sector: Technology

Market value: $247 billion

Dividend: 2.5%

IBM is a large-cap leader that pairs a century-long operating history with cutting-edge artificial intelligence technology operations. In fact, the company just posted earnings in January that show its generative AI book of business tallies $12.5 billion – fueling an increase of about $1 billion in additional free cash flow over the prior year. While not as flashy as other Big Tech names, IBM offers a unique opportunity for income investors looking for a substantive dividend in the tech sector.

Lockheed Martin Corp. (LMT)

Sector: Industrials

Market value: $148 billion

Dividend: 2.2%

Lockheed Martin is a global defense leader that has built a name for itself with iconic war machines including the F-35 and the C-130 Hercules. The unfortunate reality of rising geopolitical tensions supports long-term demand for its products, and LMT is riding recent momentum with a 45% gain over the last 12 months. The company just boosted its quarterly payout to $3.45 per share in December, up significantly from $1.65 per share paid in 2016 and reflecting a strong commitment to shareholders through continuous dividend growth.

NextEra Energy Inc. (NEE)

Sector: Utilities

Market value: $193 billion

Dividend: 2.5%

NextEra Energy is the largest publicly traded utility in the U.S., with more than 6 million customer accounts, mainly in Florida. Utilities are among the most reliable dividend stocks out there thanks to regulated operations and near-monopolies in their geographic regions. These factors generally provide stable earnings, but the added scale of NEE makes it a strong option for investors. The firm’s dividends have more than tripled since 2014 and remain very sustainable based on earnings projections for the foreseeable future.

Verizon Communications Inc. (VZ)

Sector: Communication services

Market value: $209 billion

Dividend: 5.8%

Verizon is the largest wireless provider in the U.S., serving nearly 150 million customers. Massive scale generates consistent cash flow, supporting one of the most generous dividends among blue-chip stocks. While network investments have resulted in high debt levels, easing interest-rate conditions should improve financial flexibility. With dividends consuming less than 60% of earnings, Verizon remains a reliable income stock in a data-driven world.

Williams Cos. Inc. (WMB)

Sector: Energy

Market value: $88 billion

Dividend: 3%

Williams operates more than 33,000 miles of natural gas pipelines across the U.S., and is an integral part of the energy supply chain of North America. Its midstream model delivers steady cash flow and reduces exposure to energy price swings. After restructuring its dividend – and its corporate operations – roughly a decade ago, Williams has rebuilt investor trust in recent years through consistent dividend growth and share appreciation. Specifically, payouts are now 53 cents quarterly. That’s down from the peak rate of 64 cents, but up significantly from 20 cents per share back in 2016.