1X Technologies is a robotics and artificial intelligence company developing general-purpose humanoid robots for home use.

The OpenAI-backed startup has been testing its robots in hundreds of homes since early last year, and is now taking pre-orders. With a $200 deposit, customers can secure early access to the company’s NEO robot at a price of $20,000.

The robot, which can complete a variety of home tasks, is available in tan, gray, or dark brown. The first orders are expected to ship sometime in 2026.

Behind the scenes, 1X is reportedly seeking to raise $1 billion at a valuation of at least $10 billion.

If successful, the round would represent more than a twelve-fold increase over its prior valuation and rank among the largest private financings in the fast-growing humanoid robotics sector.

Still, a public offering is likely a long way off.

But that doesn’t mean you can’t invest in 1X today.

Can you buy 1X stock?

1X is still a private company. It’s not publicly traded, so there’s no 1X stock symbol, and no way to buy it in your regular brokerage account.

That said, if you qualify as an accredited investor, you can buy its shares on Hiive.

Accreditation requirements

It’s easy to see if you qualify as an accredited investor. You only need to meet one of the following criteria:

Have an annual income of $200,000 individually or $300,000 jointly.

Have a net worth that exceeds $1,000,000 (excluding your main residence)。

Be a qualifying financial professional (have a Series 7, 65, or 82 license)。

If any of these apply, you qualify. Just register with the platform below, and Hiive will verify your status.

Hiive is a pre-IPO marketplace where accredited investors can buy shares of more than 3,000 leading technology companies.

Can retail investors buy 1X stock?

No, there is no way for retail investors to invest in 1X Technologies at this time.

However, you can invest in Tesla and Boston Dynamics, two of the company’s primary competitors in humanoid robotics.

Tesla

Tesla (TSLA) is developing Optimus, a general-purpose humanoid robot initially designed for factory work, with plans to expand into home use later on.

While still early, Tesla has steadily demonstrated progress in mobility, dexterity, and the ability to perform real-world tasks.

As of January 2026, Optimus v3 is transitioning from internal testing to early production. Tesla has established a pilot production line targeting at least 50,000 units in 2026, though the robots are still largely assembled by hand.

Retail investors can gain exposure to Tesla’s humanoid robotics efforts by purchasing Tesla stock. That exposure comes bundled with Tesla’s core businesses in electric vehicles, energy storage, and software.

Elon Musk has said he believes Optimus could ultimately become “the biggest product of all time.”

Boston Dynamics

Following its live demo at CES in January 2026, Boston Dynamics is widely viewed as a frontrunner in humanoid robotics.

That said, the company remains focused primarily on industrial applications rather than home use. Its humanoid robot, Atlas, weighs roughly 200 pounds, which is well-suited for manufacturing environments but far less practical for households.

So, while Boston Dynamics is one of the most advanced robotics companies in the world, it’s targeting a different segment of the market than 1X.

Boston Dynamics is also a private company, but investors can gain indirect exposure through its owners. It is majority-owned by Hyundai Motor Company (KRX:005380), which acquired an 80% stake in 2021, with SoftBank Group (SFTBY) retaining the rest.

Buying shares of Hyundai or SoftBank provides exposure to Boston Dynamics alongside each company’s broader businesses.

When will 1X IPO?

At this point, 1X Technologies has made no mention of plans to go public and has not indicated that an IPO is a near-term priority.

That’s not especially surprising. While 1X has raised a few private rounds and attracted high-profile backers, it’s still early in the commercialization phase.

Before an IPO becomes realistic, the company will likely need to demonstrate that it can consistently manufacture, deploy, and sell humanoid robots at scale.

In practice, that means proving functionality and demand, building a repeatable production process, and generating meaningful revenue. Until those pieces are firmly in place, an IPO is likely still a long way off.

The history of 1X

1X Technologies was founded by ?ivind B?rnich, a Norwegian roboticist, in 2014.

The company, originally named Halodi Robotics, was initially focused on developing safety drives and full-body control systems for industrial and healthcare robotics.

In 2018, it released its first humanoid robot, EVE, a wheeled android designed for logistics, security, and medical environments.

A few years later, in 2022, the company shifted its focus away from industrial applications and toward home-use robots, rebranding as 1X Technologies.

1X’s inflection point came in March 2023, when OpenAI led its $23.5 million Series A.

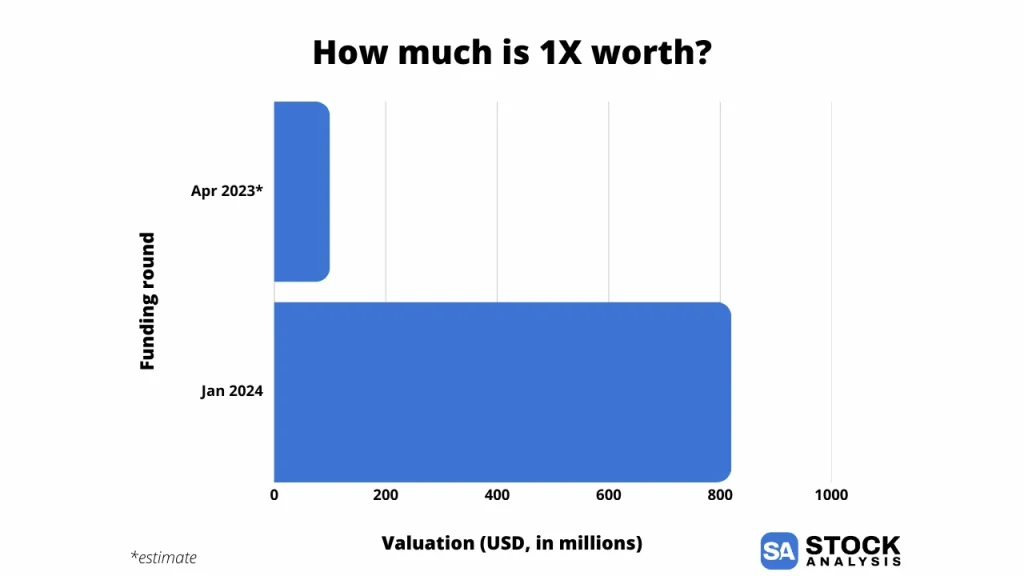

The round was followed by a much larger $100 million Series B in January 2024, signaling growing investor confidence in the company’s consumer-robotics ambitions and establishing it as one of the major humanoid robotics companies.

Product development accelerated quickly after that.

In August 2024, 1X unveiled NEO Beta, a bipedal humanoid robot designed for general household tasks, followed by a more refined NEO Gamma in February 2025.

Throughout 2025, the company placed NEO in “a few hundred to a few thousand” homes to test its systems in real-world environments. These deployments, however, were not autonomous.

Every task NEO performs — folding laundry, unloading the dishwasher, fetching water — is carried out by a remote human operator using the robot’s cameras and a VR interface to control its movements in real time.

In October 2025, just a month after reports emerged that 1X was seeking up to $1 billion in new funding, the company opened pre-orders for NEO.

Early adopters can put down a $200 deposit to secure a $20,000 purchase price of the robot, available in tan, gray, or dark brown, with delivery expected in 2026.

Just one problem: NEO is not expected to be autonomous until 2027, which means all of the early units will continue to rely on company-employed operators.

During this period, owners will schedule sessions through an app explaining what they’d like done and when — e.g., plant watering on Tuesday mornings, vacuuming on Wednesdays — and a remote operator will execute them on NEO’s behalf.

While this certainly falls short of true autonomy, NEO is a glimpse into the future of where home robotics is headed, and it’s not hard to see how the technology will evolve from here.

What is 1X’s valuation?

As mentioned above, 1X’s most recent round came in January 2024 when it raised $100 million in its Series B. The round brought its total funding to just under $125 million and valued the company at $820 million.

Then, in September 2025, news broke that the company was seeking an additional $1 billion at a valuation of at least $10 billion. The news came just days after competitor Figure AI closed a $1 billion round of its own at a $39 billion valuation.

There has been no update on the progress of this round as of late January.

Here’s a look at how its valuation has changed over time: