U.S. stocks have delivered strong returns for more than a decade, but a growing body of valuation data suggests the market may be running too hot.

One widely cited gauge is the cyclically adjusted price-to-earnings ratio, or CAPE, introduced by economist Robert Shiller in his book, “Irrational Exuberance.”

The CAPE ratio takes the current price of the S&P 500 and divides it by the average of inflation-adjusted earnings over the previous 10 years. By averaging profits across expansions and recessions, CAPE attempts to filter out the noise from temporary booms or busts.

At the height of the dot-com bubble in November 1999, the Shiller CAPE reached 44.2. As of February 2026, it sits around 39.9, well above its long-term historical mean of 17.3 and median of 16.1.

Elevated CAPE readings have historically preceded periods of muted stock market returns. After the dot-com bubble burst, U.S. equities experienced a period of stagnation known as “The Lost Decade.” In 1928, ahead of the Great Depression, valuations were similarly extended.

Market concentration adds another layer of concern, with the 10 largest companies in the S&P 500 now accounting for roughly 41% of the index.

Many of these firms are concentrated in the technology sector, with heavy exposure to artificial intelligence. That risk has prompted some investors to look elsewhere for opportunities, with emerging markets offering one particularly appealing alternative.

“The term ’emerging markets’ refers to countries that are in the middle stage of their development, only recently industrialized or just opened their markets up to foreign investment,” explains Brendan Ahern, chief investment officer at KraneShares. “The largest examples include China, India and Brazil, with some other examples being Turkey, Thailand and Indonesia.”

For emerging markets, exchange-traded fund (ETF) flow data provides insight into investor sentiment. A net inflow means more money entered a fund category than left it over a given period.

According to ETF Central, the 31 ETFs in the emerging-markets blended cap segment ranked third in trailing three-month inflows, attracting $25.5 billion in new capital and posting an average return of 12.2% over that span, compared with 3.9% for U.S. large-caps.

While U.S. stocks have outperformed over much of the past decade, leadership does not last forever. For example, in 2025, the iShares Core S&P 500 ETF (ticker: IVV) returned 17.9%, but the iShares MSCI Emerging Markets ETF (EEM) strongly outpaced it with a 33.3% gain.

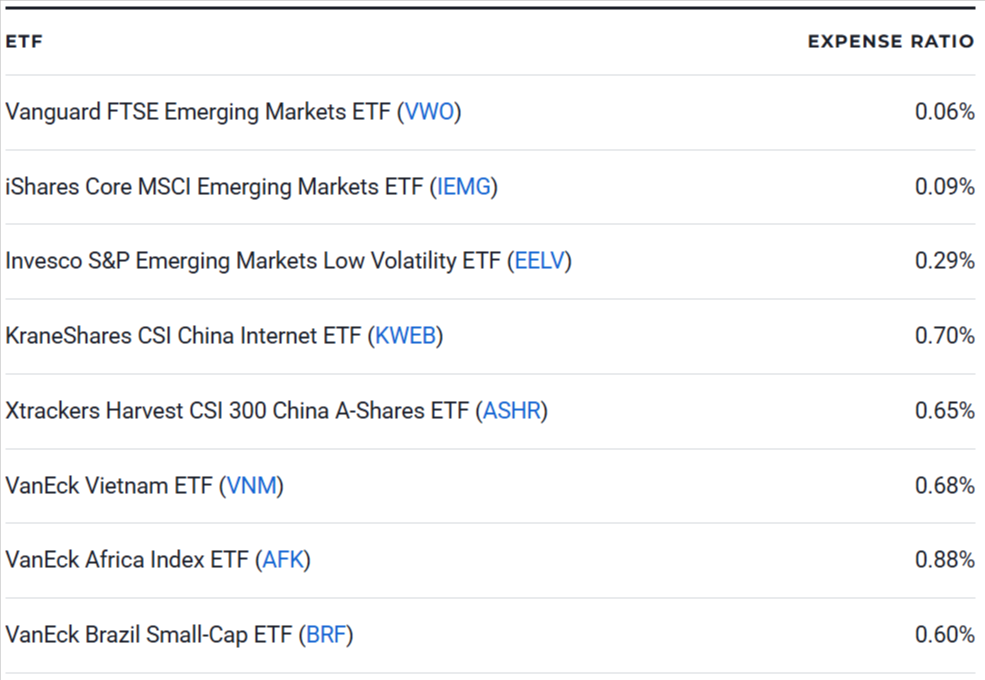

Here are eight of the best emerging-market ETFs to buy in 2026:

ETF

1.Vanguard FTSE Emerging Markets ETF (VWO)

2.iShares Core MSCI Emerging Markets ETF (IEMG)

3.Invesco S&P Emerging Markets Low Volatility ETF (EELV)

4.KraneShares CSI China Internet ETF (KWEB)

5.Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR)

6.VanEck Vietnam ETF (VNM)

7.VanEck Africa Index ETF (AFK)

8.VanEck Brazil Small-Cap ETF (BRF)

Vanguard FTSE Emerging Markets ETF (VWO)

“Emerging-market ETFs present an easy, diversified, low-transaction-cost and low-friction path to invest in emerging-market countries using a brokerage account or with the help of a financial advisor,” says Michael Ashley Schulman, partner and chief investment officer at Running Point Capital Advisors. A popular option is VWO, which tracks the FTSE Emerging Markets All Cap China A Inclusion Index.

VWO’s holdings span 6,200 market-cap-weighted equities with a bias toward China, Taiwan and India. Notably, South Korean equities are absent, because FTSE classifies them as developed markets, unlike other index providers like MSCI. Thanks to recent fee cuts, VWO now charges a very competitive 0.06% expense ratio, which works out to just $6 in annual fee drag for a $10,000 investment.

iShares Core MSCI Emerging Markets ETF (IEMG)

“When selecting emerging-market ETFs, you should consider whether you want broad exposure to multiple developing economies around the globe, or a focus on a specific country,” Schulman says. “A growing global middle-class population within emerging-market countries could fuel economic expansion at a multiple of general global GDP growth as long as there is enough support.”

If your goal is betting on the overall growth of emerging markets and not a single country, IEMG could be a good holding. This ETF holds over 2,600 stocks. Unlike VWO, IEMG’s use of an MSCI index results in a sizable 16% allocation to South Korean equities behind the usual China and Taiwan overweight. The ETF charges a 0.09% expense ratio, higher than VWO but still very reasonable for its category.

Invesco S&P Emerging Markets Low Volatility ETF (EELV)

VWO and IEMG are market-cap weighted, which emphasizes size as the primary factor for stock selection and weighting. Investors looking for a lower-risk alternative may prefer EELV. “EELV holds 200 emerging-market stocks with the lowest one-year trailing volatility, as defined by standard deviation of return,” explains Nick Kalivas, head of factor and core equity product ETF strategy at Invesco.

In addition to its low-volatility tilt, EELV also pulls double duty as a decent dividend strategy thanks to a 5.4% 30-day SEC yield. “EELV is expected to provide a smoother investment experience by avoiding both sharp market increases and decreases, making it attractive for more risk averse investors,” Kalivas says. The ETF charges a 0.29% expense ratio.

KraneShares CSI China Internet ETF (KWEB)

“We believe it is also important for investors to understand that not all emerging markets are created equal,” Ahern says. “In particular, China is unique within emerging markets due to its size as the second-largest economy in the world and its performance characteristics.” The prominence of China has resulted in many Chinese equity ETFs, especially more targeted strategies focusing on a specific sector.

Investors interested in capturing the growth from China’s technology sector may find KWEB appealing. This ETF is sizable, at $7.4 billion in assets under management. It tracks the CSI Overseas China Internet Index, which includes companies like Alibaba Group Holding Ltd. (9988.HK), Tencent Holdings Ltd. (0700.HK), Baidu Inc. (9888.HK) and PDD Holdings Inc. (PDD)。 KWEB charges a 0.7% expense ratio.

Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR)

Not all Chinese equities are directly accessible to foreign investors. The popular ones are either American depositary receipts (ADRs) or H-shares listed on the Hong Kong Exchange. However, some Chinese companies like Kweichow Moutai Co. Ltd. (600519.SS) and Ping An Insurance Group Co. of China Ltd. (601318.SS) are A-shares listed on the Shanghai or Shenzhen exchanges, and are inaccessible to foreigners.

However, there is a workaround with ETFs like ASHR. “Out of the companies in the CSI 300 index, only 78 are dual-listed in Hong Kong, and these H-shares only account for about 32.5% of the total market cap,” explains Aram Babikian, head of Xtrackers sales, U.S. onshore, wealth at DWS Group. “ASHR offers access to the domestic companies that many foreign investors are restricted from directly purchasing.”

VanEck Vietnam ETF (VNM)

Most broad emerging-market ETFs are weighted by market capitalization, which means the largest countries receive the biggest allocations. As a result, smaller economies can end up underweighted or even excluded altogether. This is especially true for frontier markets such as Vietnam. However, investors can still find ETF options. For Vietnamese equities, VanEck offers VNM at a 0.68% expense ratio.

“Vietnam has rapidly become a key beneficiary of global supply chain diversification, with strong foreign direct investment and a young, increasingly skilled workforce driving industrial and export growth,” says John Patrick Lee, product manager at VanEck. “The country’s stable macroeconomic environment, expanding middle class and rising domestic consumption further support its trajectory.”

VanEck Africa Index ETF (AFK)

“AFK provides broad, one-trade access to one of the world’s last major untapped investment frontiers,” Lee says. “The fund invests in companies incorporated in Africa or deriving at least 50% of their revenues from the continent.” While single-country exposure to countries like South Africa, which is classified as an emerging market, has long been available to investors, AFK’s diversified nature makes it an outlier.

“AFK captures both the continent’s vast resource wealth, including gold, copper and other minerals central to the energy transition, and its growing financial and consumer sectors,” Lee explains. “The result is a unique entry point into a region defined by rapid urbanization, expanding financial systems and significant long-term growth potential.” However, the ETF is pricey, with a 0.88% net expense ratio.

VanEck Brazil Small-Cap ETF (BRF)

One clear trend in emerging-market ETFs is increasing specificity. Instead of broad, market-cap-weighted exposure, investors can now target individual countries, sectors or factors. BRF is an example of this more precise approach. Rather than owning Brazil’s largest firms, it targets small-cap companies that are either incorporated in Brazil or generate at least 50% of their revenues or assets there.

“Unlike headline Brazil indices, which are dominated by commodities and mega-cap financials, BRF offers a closer connection to the country’s domestic growth drivers,” Lee explains. “The fund spans consumer cyclicals, real estate, utilities and basic materials, capturing Brazil’s internal economic momentum in a way that large-cap alternatives often miss.” BRF charges a 0.6% expense ratio, waived down from 0.97%.