The global drone industry is expected to accelerate in early 2026, as a mix of legacy companies and rising newcomers drive growth in key markets such as military and defense, security and surveillance, precision agriculture, industrial inspections and retail delivery. Those segments have propelled the drone industry to new heights, with the market expected to grow from $73.1 billion in 2024 to $163.6 billion by 2030, compounding at an annual rate of 14.3% from 2025 to 2030, according to Grand View Research.

The drone industry is particularly benefiting from deep-pocketed support from the U.S. Department of Defense. Last summer, the Pentagon issued a massive round of spending on military drones, rescinding old policies that “hindered production and limited access” to drone technologies, and “unleashing the combined potential of American manufacturing and warfighter ingenuity,” according to a July 10 memo from U.S. Secretary of Defense Pete Hegseth.

Under the “Unleashing U.S. Military Drone Dominance” program, the Pentagon will spend over $1 billion on 300,000 low-cost attack drones while the U.S. Army plans to purchase up to one million drones over the next two to three years. “We believe the U.S. remains in a significant supply-constrained environment where we believe the Department of War is trying to acquire as many drones as it can,” said Austin Bohlig, a drone industry analyst at Needham & Co., in a recent research note.

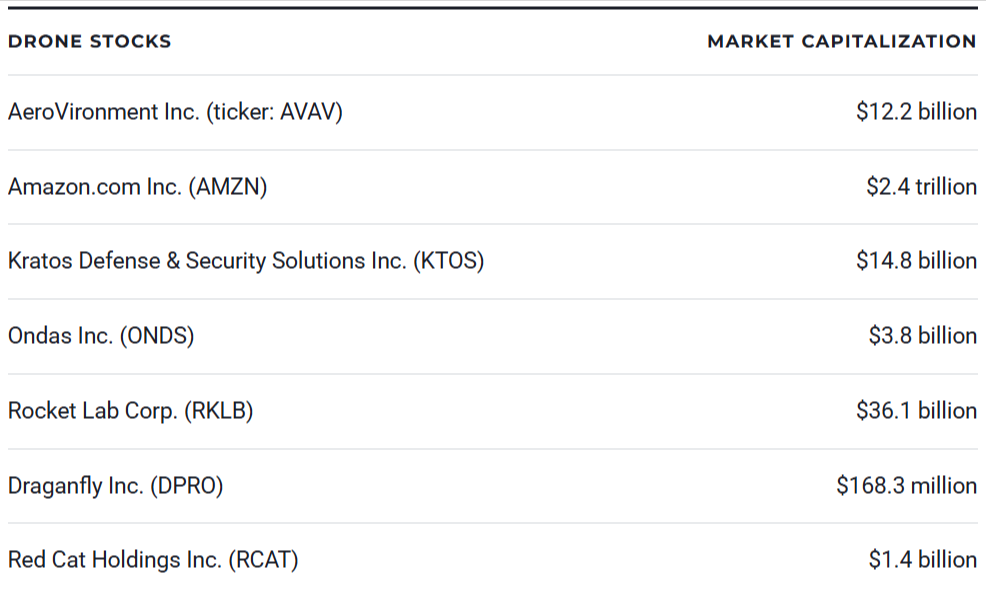

What companies are dominant in not just the military drone industry, but in other major markets as well? For those bullish on this space, here are seven of the best drone stocks to buy as the industry takes off in 2026:

Drone Stocks

AeroVironment Inc. (ticker: AVAV)

Amazon.com Inc. (AMZN)

Kratos Defense & Security Solutions Inc. (KTOS)

Ondas Inc. (ONDS)

Rocket Lab Corp. (RKLB)

Draganfly Inc. (DPRO)

Red Cat Holdings Inc. (RCAT)

AeroVironment Inc. (AVAV)

Trading at $245 per share after a sharp pullback since mid-January but up 38.2% over the past year, Arlington, Virginia-based AeroVironment remains a top-of-the-line defense play. The drone manufacturer is expected to be a big beneficiary of President Donald Trump’s recent push for a $1.5 trillion military budget in fiscal 2027, on top of 2026’s nearly trillion-dollar budget.

The company’s most recent financial quarter showed promise, with 21% organic revenue growth, and it has booked $1.4 billion in drone deals, which signifies continued confidence from buyers. Wall Street analysts are also bullish on the stock, with Needham recently re-issuing a “buy” call on AVAV with a $450 price target. Additionally, in late January, BTIG analyst Andre Madrid held a “buy” call with a $415 target price.

Amazon.com Inc. (AMZN)

Up just 0.9% year to date, Amazon stock is struggling amid a wider tech and retail rout, as market analysts also point to weaker confidence in its earnings (it reports new numbers on Feb. 5, after the bell)。 Consumers are tightening their wallets in a tough economy, but the company is showing resilience in key areas. Amazon has reported a 9.3% three-year revenue growth rate through 2025, rising profits and a stable balance sheet.

Amazon’s drone delivery program, Prime Air, is on track to deliver packages in under 30 minutes, with a 7.5-mile delivery radius and top speeds of 50 miles per hour. The program is up and running in 10 U.S. cities and plans to expand to 50-plus cities globally, with a goal of reducing last-mile delivery costs by up to 40%. Amazon leadership has said that, with total U.S. digital sales projected to surpass $1.5 trillion in 2026 and AMZN holding about 40% of those sales, drone delivery is a key linchpin of its strategy to improve efficiency and the customer experience.

Kratos Defense & Security Solutions Inc. (KTOS)

Kratos, a recent addition to the S&P SmallCap 600 Index, has seen its stock price pop in 2026 until the past week, up 20.3% year to date and up 165.7% over the past year. /Kratos stock is growing so fast that even Wall Street pros can barely keep up. Take KeyBanc’s Michael Leshock, who opened up his coverage of space and defense stocks in late 2025 with a buy call on KTOS and a $90 target price. A month later, the stock has already surpassed that figure and dropped back, trading around $88 per share on Feb. 5.

The San Diego-based unmanned aircraft systems company, with close ties to the military sector, is also expected to benefit from the roughly $1 trillion in U.S. defense funding for 2026 ($839 billion plus $150 billion in Golden Dome spending), a 13% increase from the 2025 budget. Kratos’ steady work in the drone technology sector should put the company in prime position to receive a substantial share of that funding.

Ondas Inc. (ONDS)

Trading around $9 per share and up 472.8% over the past year, this West Palm Beach, Florida-based wireless radio systems company develops unmanned aircraft systems and secure private wireless networking systems, primarily in the U.S., Israel and India.

Ondas recently reported a 6.6% three-year revenue growth rate, indicating moderate growth relative to industry competitors and improvements in liquidity and short-term balance sheet stability. On the downside, ONDS’ operating, net and gross margins are down significantly, which could threaten the company’s financial stability going forward.

Ondas is moving aggressively across multiple drone fronts, securing a $20.9 million contract with the U.S. Army to support the C100 UAS and Multi-Mission Payloads. It’s also investing in production, having recently opened what it calls Drone Factory 01, a 90,000-square-foot manufacturing facility in Huntsville, Alabama. The company’s Optimus drone was also recently added to the Defense Contract Management Agency’s Blue List, which recognizes Optimus as part of the Defense Department’s official catalog of approved, secure and National Defense Authorization Act-compliant unmanned aircraft systems and components.

Rocket Lab Corp. (RKLB)

Trading 154.9% higher than it did last February, Long Beach, California-based Rocket Lab develops spacecraft and systems and provides launch services for government and commercial customers. Rocket Lab doesn’t produce pure drones; instead, it builds reusable orbital rockets. Its flagship Electron rocket has completed 81 launches and has deployed 248 satellites. The company’s next spacecraft, Neutron, is still set to launch in 2026 after a fuel tank rupture during testing in late January, and it is expected to carry larger payloads.

The company recently secured its largest contract to date, securing a $816 million from the U.S. Space Development Agency to build an 18-mission critical missile defense satellite constellation. The SDA deal steers Rocket Lab into a new space, moving from just launching rockets toward a wholesale space delivery operation, capable of building satellites and subsystems for a burgeoning number of clients.

Although the stock has a market cap of $36 billion, it’s especially volatile relative to the broader market, with a beta of 2.2 as of early February. That may be due in part to the company’s heavy debt load, which it’s using to finance growth. Its three-year revenue growth rate is 44% with just over 52% in the past 12 months, signaling RKLB is on the right track.

Draganfly Inc. (DPRO)

Up 114.2% over the past year, Draganfly is a small firm that’s starting to compete with drone industry heavyweights in 2026. The company recently signed an agreement with the U.S. Air Force’s Special Operations Command for Flex FPV drones and training. That comes on the heels of a deal with an unnamed defense industry contractor for systems support for the Commander 3XL platform, an unmanned system engineered for the most demanding defense and government missions.

Saskatoon, Canada-based Draganfly, which manufactures and commercializes unmanned aerial vehicle systems, went public in late 2019 and has been ramping up sales over the past two years, although the company is still lagging on profitability, a common affliction among young tech startups.

With a market cap of just $230 million Canadian dollars ($168 million) and ongoing losses, Draganfly isn’t exactly an investor magnet right now, but it does offer long-term potential. While not widely covered to date, sector analysts have gradually been hiking their estimates for Draganfly. A recent consensus rating from four analysts on TipRanks is a “strong buy,” and the company recently received new coverage from Northland with an “outperform” rating.

Red Cat Holdings Inc. (RCAT)

Trading at $11 per share with an eyebrow-raising 59.3% return year to date, this San Juan, Puerto Rico-based drone services company is coming up fast. Operationally, the small-cap company specializes in software systems for drones and other robotics products. Its navigation and mapping business provides imaging tools to collect detailed location data, and the company also develops systems that plan and control flight operations and analyze data in real time.

Red Cat expects fourth-quarter revenues to range from $24 million to $26.5 million, representing a roughly 1,831% increase from the $1.3 million recorded in Q4 2024. Full-year revenues for 2025 are expected to be between $38 million and $41 million, representing about a 150% increase from the $15.6 million reported for full-year 2024.

Company leaders say the uptick in revenues stems from multiple issues. “This outperformance was driven by robust demand from defense and government customers, expanding program wins, and our ability to rapidly scale production to meet mission-critical requirements,” said Jeff Thompson, CEO of Red Cat. “As we look ahead into 2026, we see continued growth, supported by an increased pipeline, improving operating leverage, and our expanding role as a trusted provider of next-generation unmanned systems.”

In late January, Northland boosted its price target on RCAT to $22 per share, citing the company as “uniquely positioned as a leading UAS and USV vendor.” That could be enough to attract growth-minded investors focusing on drones for the long haul.