The Best T. Rowe Price Funds for Retirement

Mutual fund giant T. Rowe Price, whose funds are widely used in 401(k) plans, managed $1.8 trillion in assets as of Dec. 31, making it one of the largest providers in the workplace retirement market.

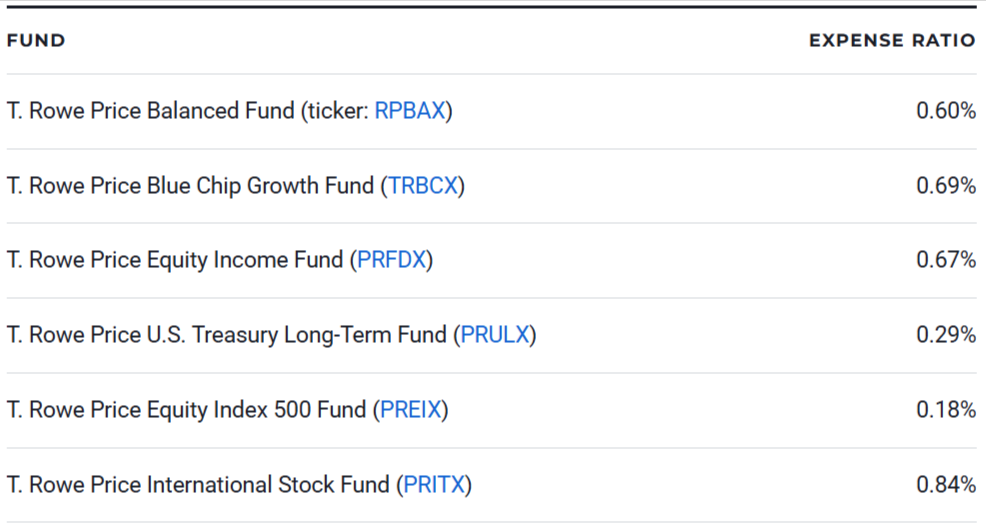

Here are six of the most popular T. Rowe Price funds that retirement savers may find in their companies’ menu of investment choices:

Fund

T. Rowe Price Balanced Fund (ticker: RPBAX)

T. Rowe Price Blue Chip Growth Fund (TRBCX)

T. Rowe Price Equity Income Fund (PRFDX)

T. Rowe Price U.S. Treasury Long-Term Fund (PRULX)

T. Rowe Price Equity Index 500 Fund (PREIX)

T. Rowe Price International Stock Fund (PRITX)

T. Rowe Price Balanced Fund (RPBAX)

As the name suggests, this fund offers a standard moderate-allocation strategy for investors seeking growth along with income, while also adding a measure of capital preservation.

Over the long haul, the fund has typically kept a greater share of its assets in stocks. According to T. Rowe Price, the fund “normally invests approximately 65% of total assets in U.S. and foreign common stocks and 35% in fixed-income securities.”

Currently, stocks make up about 42% of the portfolio, suggesting managers have dialed back their exposure after healthy gains in U.S. stocks over the past year.

The fund’s largest holding is the T. Rowe Price Real Assets Fund (PRIKX), which invests in sectors such as energy, real estate, infrastructure and commodities.

T. Rowe Price Blue Chip Growth Fund (TRBCX)

This fund invests in U.S. companies with leading market positions, seasoned management teams, strong balance sheets and above-average earnings growth.

“Being actively managed means it’s more flexible than an index fund, which means the managers can respond to market shifts,” says Melissa Cox, a certified financial planner (CFP) at Future-Focused Wealth in Dallas. “But there’s a tradeoff: Active funds usually come with higher fees, and growth stocks tend to be more volatile.”

The fund, which is benchmarked to the Russell 1000 Growth index, aims to track the performance of large U.S. growth stocks. It charges 0.69% in annual expenses, significantly higher than the T. Rowe Price Equity Index 500 Fund (PREIX), a lower-cost alternative that tracks the broader market.

T. Rowe Price Equity Income Fund (PRFDX)

The actively managed fund invests in large-capitalization U.S. companies with higher-than-average dividend yields. The fund’s managers pick stocks based on company fundamentals rather than analyzing macro trends.

Sector diversification helps minimize volatility.

“The portfolio generally tilts toward value-oriented stocks within the Russell 1000 universe,” says Jay Fedak, a CFP at Fedak Financial Planning in New Milford, Connecticut.

He adds that this fund is suitable for stock investors who prioritize dividend stability over price growth.

PRFDX’s expense ratio of 0.67% is high relative to exchange-traded funds (ETF) such as the Vanguard Dividend Appreciation ETF (VIG), Fedak says.

The Vanguard ETF tracks the S&P U.S. Dividend Growers Index, which helps keep costs low without active stock picking.

T. Rowe Price U.S. Treasury Long-Term Fund (PRULX)

This fund invests in high-quality, long-dated U.S. Treasury bonds. Its benchmark is the Bloomberg U.S. Long Treasury Index, which tracks debt securities maturing in 10 years or more.

Currently, 99% of the fund’s holdings are Treasurys, with a 1% allocation into cash. This narrow scope means it’s laser-focused on high credit quality as well as duration exposure.

Duration measures the time it takes for investors to receive their principal back, factoring in interest rate changes.

Long-dated bonds are more sensitive to interest rates than those with shorter terms to maturity. On the plus side, these government bonds offer high protection against credit risk. The fund’s effective duration of 14.6 years means price swings can be amplified when interest rates rise or fall sharply.

T. Rowe Price Equity Index 500 Fund (PREIX)

T. Rowe Price is better known for actively managed funds than index-based products, but this one is an exception.

“This fund is designed to closely track the performance of the S&P 500 while providing broad exposure to large-capitalization U.S. equities,” Fedak says. “It is available for the investors who are simply seeking overall U.S. market performance.”

Fedak points out that the fund’s expense ratio of 0.15% is quite low, but still higher than some rival S&P index products, such as the Vanguard S&P 500 ETF (VOO) and the Fidelity 500 Index Fund (FXAIX)。 Because of its higher fee, T. Rowe’s Equity Index 500 Fund has underperformed some rival funds.

T. Rowe Price International Stock Fund (PRITX)

International stocks should be included in a diversified retirement portfolio. The actively managed T. Rowe Price International Stock Fund has an average market capitalization of $77 billion, with Europe, Japan and the Pacific being the most heavily weighted regions.

“Holdings typically reflect emphasis on fundamentals including competitive positioning, earnings and balance-sheet strength,” Fedak says.

As U.S. stocks surged over the past 15 years, international stocks fell out of favor.

“However, it seems the worm has finally turned. International and global funds have been on quite a run since early 2025,” Fedak says. He adds that U.S. stocks may be overdue for a cooldown, but it’s tough to say whether international stocks will continue to outperform.