Blue-chip stocks are companies that offer the potential for long-term profitability, traditionally thanks to factors like high-quality management and consistent dividend payments. Given the current uncertainty on Wall Street, it’s worth taking a look at your portfolio to ensure these foundational investments are well-represented among your holdings.

Nothing is certain on Wall Street, of course. But the consistent results delivered by blue-chip stocks can provide peace of mind across any market environment. For investors at or near retirement, the stability offered by leading blue chips is often preferable to higher-risk assets that offer the potential for higher rewards.

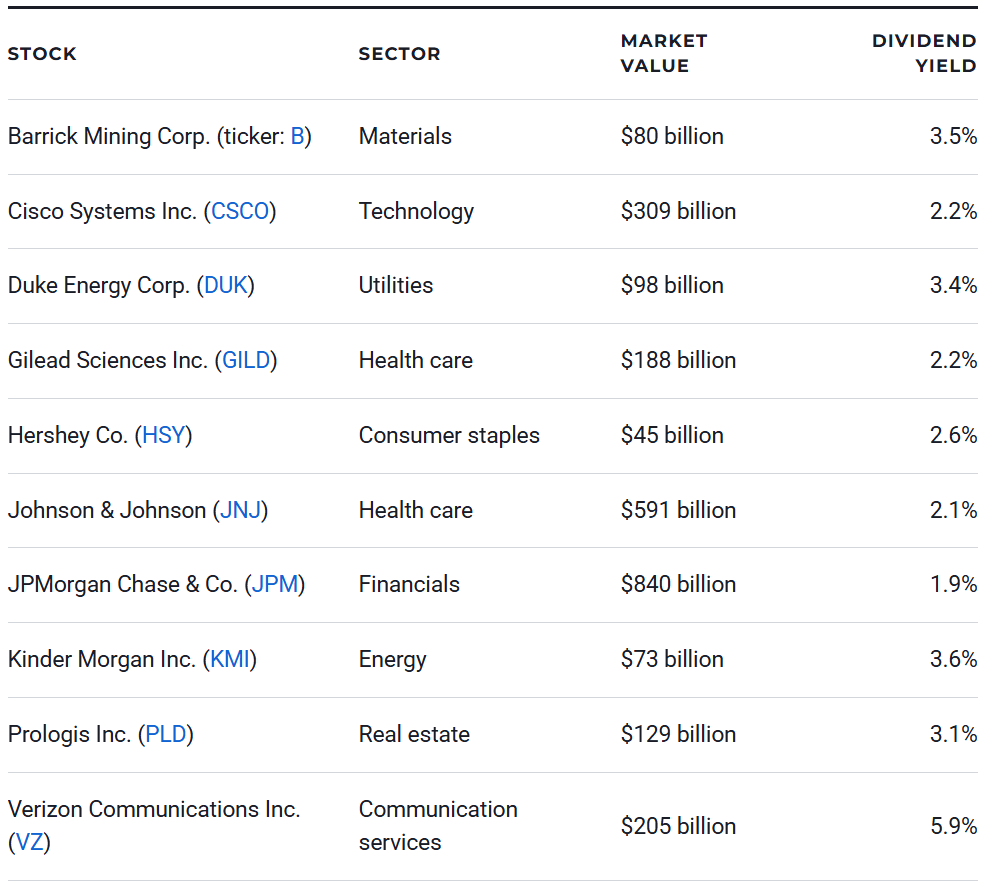

The following 10 stocks are worthy of consideration thanks to market values of more than $30 billion and above-average dividend yields:

Stock

Barrick Mining Corp. (ticker: B)

Cisco Systems Inc. (CSCO)

Duke Energy Corp. (DUK)

Gilead Sciences Inc. (GILD)

Hershey Co. (HSY)

Johnson & Johnson (JNJ)

JPMorgan Chase & Co. (JPM)

Kinder Morgan Inc. (KMI)

Prologis Inc. (PLD)

Verizon Communications Inc. (VZ)

Barrick Mining Corp. (B)

Sector: Materials

Market value: $80 billion

Dividend: 3.5%

Blue-chip materials stock Barrick is one of the world’s largest dedicated gold miners, offering exposure to the thriving precious metals market. And unlike an investment in bullion, Barrick delivers a consistent dividend yield that is well above the typical S&P 500 component. Headquartered in Toronto, Barrick holds ownership interests in mines with approximately 270 million metric tonnes of proven gold reserves. With gold prices currently hovering around $5,000 per ounce after a 67% increase over the last 12 months, it’s no surprise this stock has delivered big gains lately.

Cisco Systems Inc. (CSCO)

Sector: Technology

Market value: $309 billion

Dividend: 2.2%

While there are larger and more fashionable names in the tech sector, Cisco stands out because of it scale and pedigree alongside generous and sustainable dividend payments. The company has traded on the Nasdaq since 1990 and has consistently increased dividends since its first-ever payout in 2011. Whether it’s network security or cloud-based solutions, CSCO offers the building blocks of just about any company’s IT network. While AI is all the rage, Cisco remains a rare example of stability and income potential in the tech sector that is hard to match.

Duke Energy Corp. (DUK)

Sector: Utilities

Market value: $98 billion

Dividend: 3.4%

By some measures, Duke Energy is the largest electric utility in the U.S. Based in North Carolina, the company serves more than 10 million electric and natural gas customers across the Southeast and Midwest. Duke’s scale makes it a compelling long-term holding, and its ongoing investment plans strengthen the case even further. In 2025, the company increased its five-year capital expenditure plan to $83 billion – roughly 14% above prior estimates – to meet rising power demand driven by the promise of AI as well as regional population expansion.

Gilead Sciences Inc. (GILD)

Sector: Health care

Market value: $188 billion

Dividend: 2.2%

With roughly 50% gains in the last 12 months, GILD is among one of the best-performing stocks in the health care sector. The drugmaker’s consistent outperformance comes from a robust product pipeline and high-margin therapies addressing complex diseases, including specific cancers and HIV/AIDS. In addition to strong share price performance, dividends have increased steadily from 43 cents quarterly in 2015 to 79 cents at present. And looking forward, annual payouts are less than 40% of this fiscal year’s earnings projections, hinting that ample headroom remains on distributions.

Hershey Co. (HSY)

Sector: Consumer staples

Market value: $45 billion

Dividend: 2.6%

Hershey’s stock is up about 40% in the last 12 months, proving that a low-risk consumer staples stock can still put up significant gains for shareholders. Sweets may not be the healthiest option at the grocery store, but Hershey’s dominant position fuels a tremendously reliable business with generous income for stockholders. In February, the company declared a $1.45 quarterly payout that marks its 15th consecutive year of dividend increases.

Johnson & Johnson (JNJ)

Sector: Health care

Market value: $591 billion

Dividend: 2.1%

A great stock to buy if you’re looking for stability is so-called “widow-and-orphan” stock Johnson & Johnson. That term comes from the notion that investors have long bought shares of JNJ with the goal to provide for their families if the unexpected happens and takes away a household’s breadwinner. There’s good reason for that confidence, too, as this iconic company has been operating for more than 140 years and is one of just two publicly traded U.S. stocks with a top-notch AAA credit rating. What’s more, the company executed its 63rd consecutive year of dividend growth in 2025, proving a long-term commitment to income that few other stocks can match.

JPMorgan Chase & Co. (JPM)

Sector: Financials

Market value: $840 billion

Dividend: 1.9%

While the “Big Four” U.S. banks are in a class by themselves, JPMorgan Chase stands apart from other financial behemoths. It has the largest market capitalization of any bank in the world (excluding state-owned Chinese institutions) and is the largest bank in the U.S., with nearly $4 trillion in assets. With roots dating back to 1799, JPMorgan Chase has long been a leader in global banking and has a track record of thriving even during the toughest economic environments. Consider that JPM was the among the first U.S. banks to restore its payout after the financial crisis of 2008, and its fire-sale acquisition of Bear Stearns and Washington Mutual during that period of turmoil only strengthened this leader’s position in the industry even as other big banks remain well below their highs from two decades ago.

Kinder Morgan Inc. (KMI)

Sector: Energy

Market value: $73 billion

Dividend: 3.6%

Finding the best blue-chip stocks in the energy sector can be tricky, as integrated oil companies are exposed to commodity market volatility and alternative energy companies are subject to the whims of governmental policies. Kinder Morgan stands apart from these other energy stocks, however, as it is a “midstream” energy company that operates approximately 78,000 miles of pipelines and 136 terminal facilities across the U.S. This business is much more stable and supports the consistent earnings and dividends that long-term investors can rely on. What’s more, a $3 billion stock buyback program and a significant 13% share of outstanding stock owned by insiders create structural support for this stock’s price that will help it weather short-term disruptions.

Prologis Inc. (PLD)

Sector: Real estate

Market value: $129 billion

Dividend: 3.1%

Prologis is a leading logistics real estate operator with approximately 1.3 billion square feet of warehouse and industrial space. It’s not only the largest company of its kind in the U.S., but also one of the top publicly traded real estate investment trusts on Wall Street. This special category of stock must deliver 90% of taxable income back to shareholders, creating a mandate for big and consistent dividend payments. With major tenants that include Home Depot Inc. (HD), FedEx Corp. (FDX), United Parcel Service Inc. (UPS) and Walmart Inc. (WMT), this company benefits from long-term leases and a stable customer base that provides strong and consistent revenue.

Verizon Communications Inc. (VZ)

Sector: Communication services

Market value: $205 billion

Dividend: 5.9%

Verizon one of the largest wireless providers in the U.S., serving nearly 150 million customers. Its scale generates strong and consistent cash flow, supporting one of the most generous dividends among blue-chip stocks. Hopes for lower interest rates recently are lifting shares, in the hope that VZ will deliver better performance as it dedicates less of its cash flow to debt service. And besides, with dividends consuming less than 60% of earnings, Verizon has ample support for a dividend that is nearly five times that of the typical S&P 500 component.